Working DJs are often entrepreneurial individuals who wish to avoid the path of a standard 9-5 job. Being a disk jockey allows anyone who is genuinely ambitious and passionate about music to have an exciting career that can provide a very comfortable income. But make no mistake. As a freelancer, you must take total charge of your financial life not only to be successful but also to survive in this industry long-term.

Today, we’re discussing some of the most important personal finance tips for enterprising DJs who are set on succeeding.

Why Is Everyone So Bad At Personal Finance?

If you know very little about personal finance, let me start off by giving you the good news: it’s okay.

For some reason, public schools around the world don’t find it essential to teach students almost no personal finance tips.

So consider this to be a casual lesson and a good perspective shift – it’s entirely possible to become financially successful as a DJ. Each of these personal finance tips is designed to help get you there, faster!

The Hard Truth About Personal Finance

- As a self-employed person (as virtually all DJs are), you are required by law to report your income to the IRS, and pay taxes on it. You do not want to mess with the IRS!

- The average worker stays at their job for only 4.4 years before having to switch, working a total of 15-20 jobs in their lifetime! Think you can just quit DJing and find a well-paid job in no time? Maybe you should think again.

- 50% of Americans have access to a 401K Retirement Plan through their place of employment, meaning their employer handles this complicated process for them. Ever met a DJ with this benefit? Me neither. It’s now your job to do this!

- Public education teaches you almost nothing about personal finance. In fact, 96% of Americans would fail a quiz on basic financial literacy. Fortunately, you can teach yourself.

The fact is that if you choose to give up the 9-5 life, you will have to do a little bit of extra work to ensure that your business is operating efficiently.

Let’s start with everyone’s least favorite topic – taxes.

Paying Taxes as a Self-Employed DJ

As a DJ, one of the worst possible things you can do is think you’ll get away with not paying your taxes.

It’s crazy that in a world where virtually all banking information, transaction records, and invoices are just a click of a button away, people still think they can avoid the paying income taxes they owe.

Think you have “privacy?” You don’t. The IRS can access any of your financial information at any time, with no court orders or warrants necessary. It’s the 21st century, baby. Get used to it!

If you think you “don’t make enough” to qualify for paying your fair share, you’re also probably wrong. Even people making as little as $20,000 can still get screwed if they fail to pay.

Naysayers Beware…The IRS Is Coming!

“Man, I’ve never paid my income taxes, and everything is fine! They won’t catch me.”

Wrong—again! If you fail to file a tax return for a given year, the IRS can initiate a process known as an audit. An audit allows them to look back as many decades as they please at your financial life, investigating if you’ve failed to pay what you owe.

Never heard of an audit? Check out the below video for a quick explanation.

Disclaimer: I don’t suggest using TurboTax.

The worst part is that if you are caught dodging your taxes, not only do you have to pay what you owe, but there is generally a 5% interest charge added for every month your taxes remain unpaid. Sure, it might take 10 years for them to catch up with you. But, if (or when) they do, you’ll be paying far more than if you had just done your due diligence.

Some DJs out there are one audit away from complete and total financial ruin. What’s worse is that your home, cars and even the money in your bank account can also be seized in exchange for unpaid taxes.

Taxation is no joke in the United States, my friends. It is a vast and ridiculous topic whose rules are always changing. Don’t mess with the IRS!

Fortunately, there’s an easy solution: hire a good accountant.

Hire A Tax Accountant – The #1 Personal Finance Tip for DJs

The best thing you can do here is to hire a good accountant who specializes in self-employed people.

I’ve watched friends of mine pay thousand extra in fees because of mistakes that they made when trying to do it themselves, or letting someone who pretended to know what they were talking about.

I’d also suggest avoiding companies like H&R Block, who often employ entry-level workers who cannot get jobs at more prestigious firms. While you may save a little bit on your fees, this is not something you want to skimp on. Just as DJing is a craft that takes many years to cultivate, tax accounting is very similar.

Additionally, I don’t suggest using software such as TurboTax. Having an expert to consult on these incredibly complicated tasks is invaluable. Most tax accountants offer year-round consultations, so if you ever have a question about your situation, good advice is just an email away.

The moral of the story is this: find someone who is excellent at their job, and work with them. Tax accountants can be a goldmine for various personal finance tips. It’s their job, after all!

For those of you who are interested in what exactly your accountant may be asking you, feel free to read on to the next section where we discuss strategies for reducing your taxes as a self-employed individual.

Reducing Your Taxes As a Self Employed Individual

The first thing your accountant is probably going to ask you for are details about your income, and a list of “write-offs.”

A write-off is what’s also known as a “business expense” by the IRS. Think of an expense as any money that you HAVE to spend to do keep your business running and do your job properly.

The amount of things that qualify as business expenses is rather large. Some examples include the miles that you put on your car for traveling to gigs, space in your house for a home office, record pool subscriptions, new computers, DJ gear, and even purchased music.

In essence: the government cannot tax you on money you did not earn. To be a DJ, you have to spend a fair amount of money to do your job!

Still don’t understand? That’s okay, here’s a quick video that properly explains how to use tax write-offs to your advantage!

Understanding Tax Write-Offs

See how that works? The more you are required to spend, the less you are required to pay.

Side note: The IRS has what is known as the “Hobby Loss” rule, which essentially states that you must be actively making a profit on the activity you are attempting to write off losses for. You must be a professional DJ who is actively earning yearly profit to write off expenses from it. Talk to your accountant about this!

Now that you’re actively keeping track of your expenses, and have hired an accountant, it’s time to talk about your budget.

Budgeting: Live Within Your Means

I’ll confess: I hate budgeting, and I bet you do too.

Most Americans share our disdain for tracking every penny that comes out of our pocket, but this also explains why most Americans can’t come up with as little as $400 to pay an unexpected bill.

Unfortunately, having some idea of your monthly budget is going to be necessary to save money and set yourself up for success.

This means strategically mapping out how much your rent/mortgage, vehicle expenses, bills, health insurance, and other necessities each month.

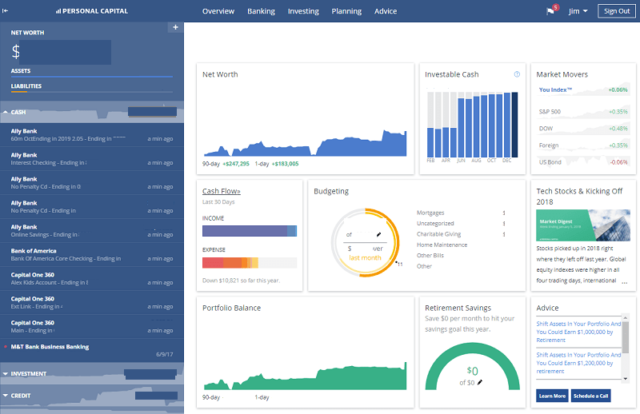

Fortunately, there’s one app that has not only made the process bearable but actually pretty fun. For my budgeting, I use Personal Capital. It gives me a detailed overview of every bank account, credit card, and investment account that I have in one view.

On top of that, it accurately tracks monthly spending from all sources. If you pull money out of the ATM, purchase something on your credit card, or even pay with PayPal, it all gets tracked in one place. You connect your accounts to the app, and it does a considerable amount of the work for you.

Personally, it took me about an hour and a half to create a monthly budget after Personal Capital highlighted my monthly spending. It reminded me that I can certainly be more frugal in some areas, but also that I shouldn’t feel too bad about purchasing things needed to do my job.

Not only does the app help with budgeting, but it also allows you to watch your money grow over time. This is where mastering personal finance tips can become fun!

I’ll admit, almost every morning after waking up, I open the app and look at my total net worth. Being able to see all of your money in front of you every day can be a huge motivator to get out there and hunt for new business. Better yet, I’ll often see that my net worth has increased from the time I went to sleep to the moment I wake up. How is this, you ask?

I save and invest the majority of the money I make from DJ’ing.

Save Dat Money: Stash Your Cash

The truth is, you should be aiming to save at least 20% of your yearly income, and that’s on the low end.

How you live your life is up to you, but if you’re someone who saves almost none of their income, you should seriously reevaluate the way you are living.

Remember that little statistic about how 25% of Americans will never be able to retire? This is why. People grossly overspend, purchasing things they have not rightfully earned with money they don’t have.

If you’ve prioritized having a $500 monthly car payment, a $2000 apartment and a Rolex watch over saving at least 20% of your income, you are making a huge mistake.

Saving money is ridiculously simple, and yet it seems to be an impossible task for most people to grasp. Savings occur when you have an excess of money earned, versus money spent in a given month. This is accomplished by either raising your income level, reducing your expenses…or hopefully both!

Sadly, the majority of Americans live deeply in debt, and this will prevent them from achieving real wealth in life. As a self-employed person, overspending can harm you far more than the average person!

You vs. Them: Self Employed People & Overspending

Having a financial profile that’s a complete and total disaster can be manageable for the average 9-5’er, surprisingly. They probably have a stable job that, while it requires them to work 40 hours a week, they can be sure their paychecks will continue to clear.

Granted, they may very well spend most of their life at a job they hate, but they may not suffer any severe consequences…right away. In other words, these people are living on borrowed time.

But it’s different for a DJ. What happens if you barely have enough money in your bank account to cover a month’s of expenses, and a nightclub gets shut down, or another DJ snakes a gig from you?

You’re screwed, that’s what happens.

We all have bills to pay, and you must have savings if a moneymaking gig goes belly up. The last thing you want to do is live paycheck to paycheck as a DJ.

Unless you’re one of the lucky few who works on a cruise ship or for a hotel chain, your income can probably be shut off at any point by forces that are far beyond your control.

At some point or another, you’re going to lose a gig, and it’s going to suck. You can, however, make it suck less by being financially prepared.

Personal finance guru Dave Ramsey suggests everybody have six months of living expenses on hand in case of a sudden job loss. Anybody who has ever been in a bad situation with a nightclub can attest to what a lifesaver a financial safety net can be.

Even if you work for a fantastic nightlife group, accidents can happen at any moment.

Accidents Happen, Be Prepared

A whole host of bad things can happen to a DJ that can take us out of the game. Even Hot Since 82 himself has occasionally been prevented from gigging because of hearing loss from tinnitus.

Even worse, what if something devastating happens at a nightclub you’re working at? Look to the case of Ray Rivera, a DJ who was sidelined from working after the tragic PULSE Nightclub shooting in 2013. It’s a scary world we live in, and it’s essential to be ready for anything.

While less tragic, but unfortunate, I once knew a DJ who was prohibited from coming into work after he had gotten into a car accident that required him to wear a cast.

The nightclub didn’t think his medical brace worked with their “look,” and suspended him from coming in until the cast was taken off.

This was totally illegal, and I even suggested he sue the people he was working for because of just how immoral this was. Sadly, that would have been another fiasco in and of itself, and in the end, he had to go three months without a paycheck before returning to work.

My personal opinion is that nightclub owners are often a “special bunch.” In other words, you should not trust 99% of them to take care of you if things go south. I wish this weren’t the case, but in my experience, it almost always is.

So, let’s say I’ve convinced you to save and spend your money accordingly. What do you do then?

Investing: The Crown Jewel of Personal Finance Tips

If you do not invest your money correctly, you are making one of the biggest mistakes there is! Money will never truly grow by just sitting there in a bank account, and actually loses value with inflation every year.

People are scared by the term “investing.” They think that you have to be some stock market guru, or expert on bitcoin to make your money work for you. This could not be further from the truth! You can start investing today with whatever amount of money you have available.

Building Wealth Passively: Retirement Accounts

Retirement planning being part of an article on personal finance tips for DJs can undoubtedly seem strange. Unfortunately for those who dismiss retirement planning, they’re missing out on the best tool for gaining wealth that exists.

The best tool you have as an investor is time. Not stock analysis skills, not the insider trading information that got Martha Stewart busted, none of that.

Time is what you need, and most of us have plenty of it.

Plus, unless you plan to be a rockstar and die early (I don’t suggest this), you’re going to need to have money when you’re old and unable to work. Considering how demanding DJ work is, I’d imagine most of us won’t be in the club in our mid-50’s, either.

Here are two accounts that a self-employed person can open to start properly planning for your retirement.

Roth IRA: A special retirement account where your money can grow tax-free. Put the money you earn while DJ’ing in, it grows like mad, and you can take it out when you turn 59 1/2.

You can see some crazy growth with a Roth IRA if you are consistent. For example, putting $500 a month in a Roth IRA for 30 years will end up being roughly $1,000,000 due to the power of compounding interest. In other words, your contributions earn interest, which then earns even more interest, and so forth.

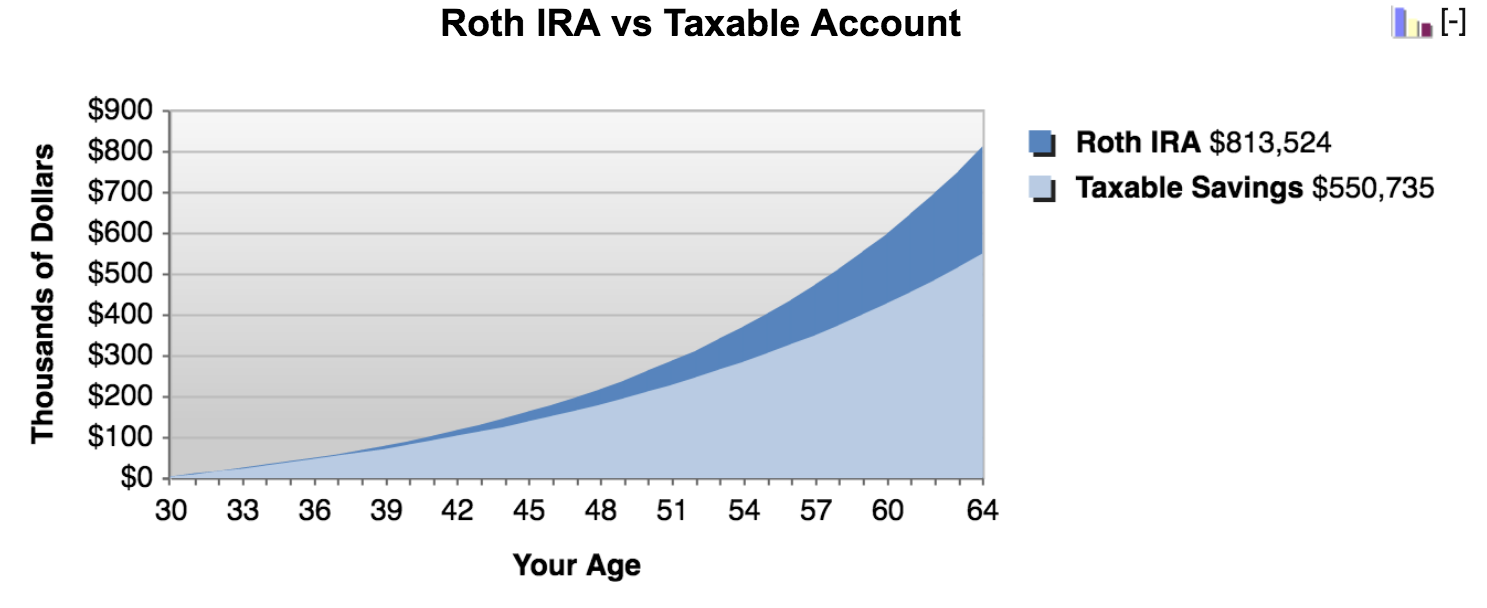

The below chart is for someone who is 30, who begins putting in $500 a month into their Roth IRA and retires at 65. They put in $192,000 over 35 years and got $813,524 back. Best of all, you can take this money out in retirement, completely tax-free.

As a DJ playing in most cities across the USA, you can easily make $500 in one night. There’s no excuse not to have a Roth IRA.

My personal choice: Vanguard Roth IRA with Vanguard Target Date Retirement Funds.

SEP-401K (Self Employed 401K): Similar to a Roth IRA, but all of your contributions qualify as a tax deduction, similar to the write-offs we discussed earlier. Depending on your unique situation, this may be the best option for you, as it allows you to grow your wealth while saving on taxes. Unfortunately, when you choose to withdraw this money in retirement, you will be liable to pay taxes on it.

My personal choice: Vanguard SEP-401K.

What Do I Put In These Accounts?

A Roth IRA or a SEP-401K is not a “stock.” These are merely containers that you can hold a variety of stocks, bonds, and other assets inside.

To read more about the different types of assets you can purchase when investing, check out Mr. Money Moustache’s famous article, “How To Make Money in the Stock Market.”

To keep things as simple as possible, I suggest choosing a diversified, target-date index fund to keep inside of each. Some of the best in the business are Vanguard’s Target Retirement funds. Feel free to do your research here, though Vanguard is an excellent place to get started.

Retirement planning should be your priority, no matter what kind of investor you are. Even if you couldn’t care less about actually retiring, investing as much money as you can into a retirement gives your money a very, very long time to grow.

But, let’s say you’ve maxed out your Roth IRA contributions, and you want to invest your money in something more comfortable to reach for in the near future.

Building Wealth Passively: Brokerage Accounts

With retirement accounts, you cannot access the money before you hit retirement age, which is usually 59.5 years old. Most people defer this even further to 65. On top of that, there are limits on how much you can put into these accounts every year.

The generally accepted suggestion here is to max out your retirement accounts and put any leftovers in a standard brokerage account. But, most people don’t have $24,500 to set aside each year (even though they should try to).

Below are two approaches for investing your hard-earned DJ dollars without locking them up in retirement accounts!

Approach #1: “Do it for me.”

Let’s say you’re the type of person who wants this all to be as easy as possible. You can’t be bothered.

If I can’t convince you to spend a little time learning about this stuff, I’d say just go sign up for an account at Betterment or one at Wealthfront.

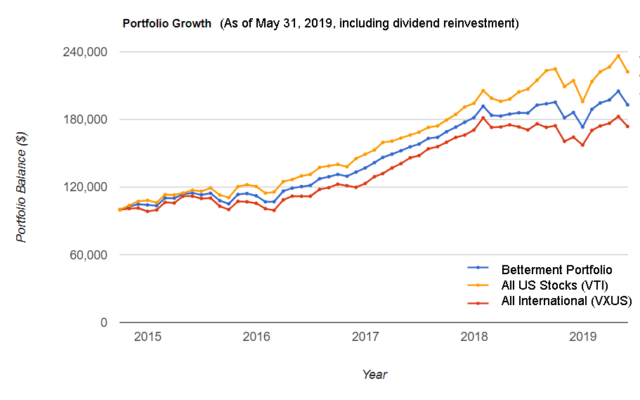

Betterment and Wealthfront are fantastic because they takes all of the guesswork out of investing. They have “robo advisors” where you simply tell it what your goals are, and fund the account, and watch your money grow. Custom algorithms choose where to put your money. They tend to perform very similarly as to index funds:

That’s it. Touch and go. The main downside is that it charges 0.25% each year of the total money you have invested. Realistically, you’re making far more than this, so it is worth it. It is still a much higher fee than a service like Vanguard.

Approach #2: I want to learn more about this.

Good! Understanding a few personal finance tips are just the tip of the iceberg.

Again, Vanguard wins out here. They offer a brokerage account that is second to none and allows you to invest in funds such as VTSAX and VTI – which are both generally solid.

In all honesty, it matters less about who you choose to go with, and more that you get started with investing as soon as possible.

“Oh, but I’ll wait until I have more money to start investing.”

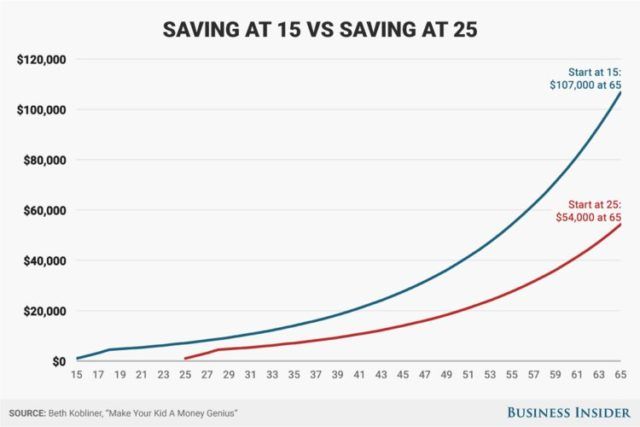

This is another huge fallacy. As I mentioned time is the best asset you have when investing money.

Look at the above chart. The blue line represents somebody who began investing just $1,000 in a Roth IRA for only three years, starting at age 15. The red line is somebody who waited until they were 25, contributing the same amount.

The blue line doubled their retirement savings with no extra work whatsoever, simply because time is on their side.

In other words: do not think that you can begin investing when you get older and “catch up” on prior years where you were more wasteful with your spending.

What About Cryptocurrency?

While I’m a huge fan of cryptocurrency and believe that there’s a lot of money to be made in the future, I tell everyone to stay away from it until they have accomplished each of the above steps.

There’s absolutely no sense in someone buying Bitcoin if they have debt, no retirement savings, and no other investments.

Do all of those things first. But, keep in mind, the value of any digital currency could very well drop to $0 tomorrow. It’s remarkably unstable.

On the other hand, some say one Bitcoin could be worth $50,000 by the end of the year. For reference, it is August 2019, and the price is exactly $11,319. Consider Bitcoin and other digital currencies to be one of the last things you invest in – because there’s no predictable results.

Investing In Yourself: One of the Personal Finance Tips That Nobody Talks About

I once met a DJ who claimed that he needed to buy $300 Air Jordans, shirts from Supreme, and finance sports car because it was an “investment in himself.” He believed that he needed to put on an image to get quality DJ gigs.

Of course, he also played only in local nightclubs. And, to the surprise of absolutely nobody, he is not a DJ anymore either. He ran out of money and had to get a job working at the mall. This isn’t investing in yourself.

Investing in yourself means that you will be getting a return on your investment. You hope to make money back…and then some.

How To Invest In Yourself As A DJ

As a DJ, there are plenty of great ways to invest in yourself. Of course, it is important to dress and look the part. Purchasing clothing and dropping money on a gym membership, nutritious food, and personal care can be an excellent investment for a DJ looking to break into the club circuit. It’s a superficial scene, after all.

Similarly, a wedding DJ will have to look the part. If you think you can rock up to a wedding wearing the same thing you’d wear to a club gig, you probably won’t be playing weddings for very long!

Appearances aside, here’s a shortlist of common ways DJs will invest in themselves:

- DJ gear that enhances your performance in a way that the crowd notices.

- Professional DJ press kit

- Subscriptions to record pools to help you build your collection.

- Music production courses.

These are all excellent ways to reinvest the money you make DJ’ing to improve the services you offer. Ideally, this means more clients, and ultimately, more money

If you save up enough money, you very well could use your DJing as a platform to get involved in another business entirely.

Exit Strategies: Small Business Ideas For DJs

It never hurts to have an additional business that piggybacks off of your DJ career to help bring in more revenue each year. While managing your money with our checklist of personal finance tips will certainly optimize your situation, some choose to expand into other sectors.

The classic model here was opening a “DJ company,” where one person would subcontract gigs to a team of DJs and keep a percentage of the fee, ensuring they’re getting paid no matter what. This model only exists in the wedding industry, bringing us to our next small business idea for DJs.

While most club DJs will never admit it, weddings often make up over half of the income that a DJ will make in a given year. The average cost of a wedding is America is $35,000, and many DJs have been crafty enough to put themselves in the middle of this transaction.

Wedding DJs: The Real Moneymakers

A proper wedding fee can pay anywhere from $1,500 to $5,000. Premium wedding packages go far beyond this. In many ways, the sky is the limit here.

Simply put: 20 weddings a year can be huge money if you have the wherewithal to arrange sound, lighting, custom playlisting, and usually being the MC for the night as well.

Beyond weddings, some DJs are highly ambitious and have gone as far as to open their own venues after carefully saving up their DJ fees for years on end.

This is obviously a huge step, and not to be taken lightly. Even still, you could look to Pittsburgh’s very own DJ Nugget as an example of a nationally known crowd-pleaser who now owns two separate venues.

Small Business Ideas, Continued.

Other DJs tend to keep things simple, perhaps by starting blogs (such as this one), record pools, and other internet-based businesses that guarantee a location independent income.

The possibilities are endless. While it’s not entirely necessary to have a second income stream as a DJ, it certainly never hurts to think about it. Most DJs are a diverse, skilled group of people who are well in tune with the needs of others. Think of this like reading the crowd, but instead, you’re reading the market.

Plus, I’m not sure how I’ll feel about being in the club as a 60-year-old man. I can hardly stand new Hip Hop today, let alone whatever will be popular then!

Conclusion & Further Reading on Personal Finance Tips

If all of this information is overwhelming to you: it’s completely okay.

Learning the ins and outs of personal finance tips is like learning to beat match. It can take a little bit of getting used to, but anybody can do it if they set their mind to it.

The topic of personal finance is massive, and this is just a starting point. Plus, this information changes year in and year out. Verify everything before making any significant financial moves, and always speak with an accountant.

My investment strategy listed above just one approach you can take to personal finance. That being said, it is one of the safest and easiest ones to get into. If you’re interested in learning more about this topic, I suggest the following resources:

- The Total Money Makeover by Dave Ramsey

- The Simple Path To Wealth by J.L. Collins

- The Mr. Money Moustache Blog

- The Millionaire Fastlane by MJ DeMarco

What are your favorite personal finance tips as a DJ? Feel free to weigh in, in the comments below!