SoundCloud has had a wild ride since it was founded in 2007, and today it was reported by Sky News that the current owners are trying to sell it for $1 billion dollars. What does this price tag mean? How could it impact DJs and producers who rely on the platform? Could this be a sign of better things, or just a capital investment moving from one set of firms to another?

Needless to say, we’re left with a lot of questions – but we’ve collected some of the facts and speculation in this article.

A hefty price to sell SoundCloud

SoundCloud’s owners (Raine Group and Temasek Holdings, who took majority stakes in the audio platform in 2017) are looking to auction off the streaming platform – with an intended billion-dollar price tag.

Obligatory Dr. Evil jokes aside, in the tech world, the coveted valuation for many startups in the last decade has been $1 billion. That’s the amount over which industry darlings are dubbed “Unicorns”. Take, for example, some of the biggest companies in the tech spector including Stripe, Instacart, SpaceX, Klarna, OpenAI, Telegram, Anthropic, and Shein – just to name a few. The way a valuation works is not off of historical performance, but rather often weighing long-term potential market development and growth opportunities.

The other way you get a valuation is more simple: it comes down to how much an investor was willing to pay when buying some or all of your company. Notably, this has happened a number of times in SoundCloud’s history. A one billion dollar figure is a significant leap from the $300 million valuation at the time of Raine and Temasek’s investment in 2017, and another $75 million investment from SiriusXM in 2020.

When the current owners invested in 2017, they likely helped the company stay afloat with much-needed cash. Since then, we’ve seen a lot of focus on monetization and profit – even at the cost of employees.

Under the leadership of current CEO Eliah Seton, SoundCloud has reported to have seen stabilization in its financial situation. This is despite their need to lay off staff, including a 20% layoff in August 2022 and a further 8% in May 2023.

But what does this mean for DJs + producers?

Since its inception in Berlin in 2007, SoundCloud has become a critical platform for independent artists, hosting over 320 million tracks from more than 40 million creators. Every DJ and producer knows the power of SoundCloud for not only music discovery and crate digging, but also as a platform on which you can be discovered.

Anytime a company goes through a sale, it can result in a significant shift for the product’s users. And honestly, it’s somewhat surprising that we haven’t seen more of a change in SoundCloud over the years as new owners and cost-cutting/profit-oriented minds have taken over.

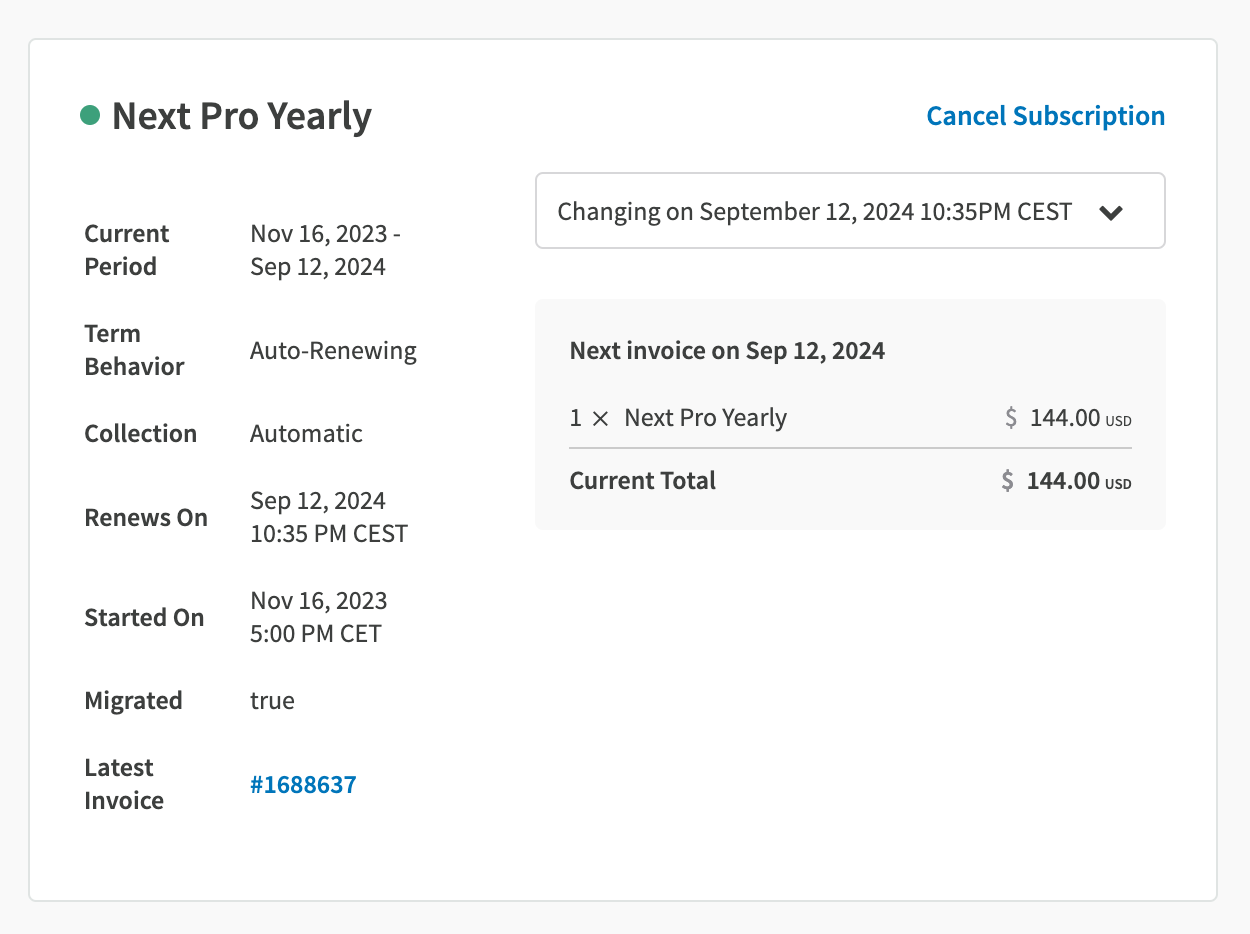

I say “more” of a change because that annual fee for uploaders has certainly seemed to get hefty. Anything more than 3 hours of uploads on your account, and you’re looking at signing up for a $144/year plan (like mine, below).

It never quite became the YouTube of audio in terms of ads monetization, did it?

For DJs and producers, it remains a core tool for so many to showcase artistic work – tracks, live sets and mixes, and even radio shows and podcast – as well as build a fan base (like/share/email-to-download gating still seems to work really well), and find new music. The sale of SoundCloud at such a high valuation could have several implications:

- Changes in platform pricing: A new ownership structure could bring changes in the platform’s features, pricing models, and policies, which could impact how DJs and producers use the platform for distribution and promotion.

- Monetization concerns: More money, more problems, right? Anytime someone pays a lot of money for a platform, they’re going to look to get a strong return on investment. Paying a billion for Soundcloud could mean different new policies for how artists earn revenue, how many ads you see, and more.

- Creative freedoms: SoundCloud has been known for its artist-friendly approach and creative freedom – generally it’s pretty easy to create and upload whatever you want. Imagine if the buyer is a rights-holding organization like a major label or distributor, where a change in ownership could lead to stricter content policies and bigger challenges for independent and unsigned artists.

Who would buy it, other than another investment firm?

Somewhat sadly, this type of sale often means that a company is at a stage where – through longevity, size, success, or some combination therein – it’s almost become a trading card for asset-holding investment companies. The current owners might be saying to themselves: “Ok, we saved SoundCloud with some cash, put a new CEO in there, now it’s on the path to profitability – let’s get 3x what we paid in this sale!” This is a gross simplification, but it serves to illustrate the framing in which you could imagine another outside partner would acquire SoundCloud. It’s probably not a passion project, but rather just another investment.

We’ve seen this before even within our industry, most recently with AlphaTheta’s (Pioneer DJ and Pioneer Pro Audio) investment firm owners KKR. KRR bought the company in 2015, pushed capital into it, and then turned it for a $55 million profit in a sale to Japanese company Noritsu in 2020.

All that aside, here’s a few reasons a non-investment firm might snap up the platform in a sale:

- The incredible user base + library: In a world where content is hyper-commodified, unique content is powerful. SoundCloud has a lot of it, and that could be attractive to companies with successful monetized subscription content platforms (Spotify, Apple Music, YouTube Premium, etc).

- Getting into music streaming: If there’s a legacy media company out there that wants to compete with the big dogs like Apple and Spotify without building their own platform, this could be a clever – albeit expensive – shortcut.

- Streamlining artist development: Talent scouting and artist development is pretty easy on SoundCloud. I could see a major label wanting to identify up-and-coming artists using the site and getting a first pass at signing them.

Ultimately, aside from someone with a huge cash war chest, it’s hard to imagine many companies eyeballing SoundCloud at such a high price point. We’ll continue to watch as this story develops and follow up if something new comes up.

Alright – enough speculation on my part. What do you all think? Will anyone pay a billion for SoundCloud, and if so, who?